UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

| | ||

| The Estée Lauder Companies Inc. 767 Fifth Avenue New York, New York 10153 | | | | | |

| William P. Lauder Executive Chairman | |  | ![[MISSING IMAGE: lg_esteelaudercom-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/lg_esteelaudercom-pn.jpg) | |

| | | | September | |

Due to ongoing concerns about the COVID-19 pandemic, we are holding the Annual Meeting in a virtual-only meeting format.

![[MISSING IMAGE: sg_williamplauder-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/sg_williamplauder-pn.jpg)

YOUR VOTE IS IMPORTANT. PLEASE PROMPTLY SUBMIT YOUR PROXY

BY INTERNET, TELEPHONE, OR MAIL.

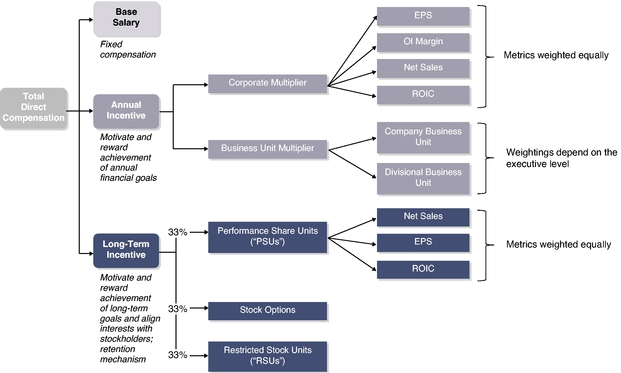

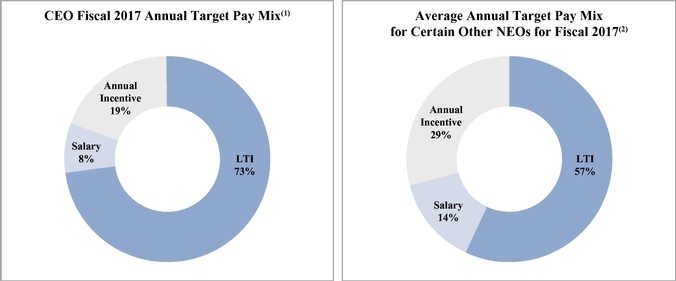

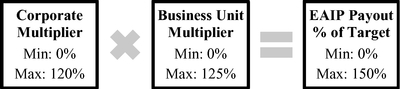

Eastern Time TABLE OF CONTENTS Related Person Transactions Policy and Procedures Proxy Procedure and Expenses of Solicitation Financial Measure Net Sales Net Sales as adjusted(1) Net Sales as adjusted in constant currency(1) Operating Margin Operating Margin as adjusted(1) Diluted EPS Diluted EPS as adjusted(1) Diluted EPS as adjusted in constant currency(1) Return on Invested Capital(2) Cash Flow from Operations Total Stockholder Return ("TSR") TSR – S&P 500 Composite 16-digit control number and follow the instructions to submit a question. Alternatively, to submit a question during the meeting, log into the virtual meeting platform at www.virtualshareholdermeeting.com/ EL2022 using the 16-digit control number and follow the instructions to submit a question. How do I cast my vote if I am a stockholder of record? During the meeting, you may vote online by following the instructions at www.virtualshareholdermeeting.com/EL2022. “street name?” Notice, as applicable. If you do not If you attend the Annual Meeting at www.virtualshareholdermeeting.com/EL2022, you may revoke your proxy and change your vote by voting online during the meeting. What if a quorum is not represented at the Annual Meeting? Item 1: the appointment of NY 10153, ten days prior to the Annual Meeting. If you hold your shares in a bank or brokerage account, you also may have the opportunity to receive copies of these documents electronically. Please check the information provided in the proxy materials mailed to you by your bank or broker regarding the availability of this service. As of the Record Date, Class I is comprised of five directors, Class II is comprised of six directors, and Class III is comprised of six directors. Rose Marie Bravo, a Class I director, will retire from the Board effective November 17, 2022, and the Board size will be decreased to 16 members, effective November 17, 2022. The Board believes that the above-mentioned attributes, along with the leadership skills and other experience of its Board members, some of which are described in the biographies below, provide the appropriate perspectives and judgment to guide the As of the Record Date, eight of our directors are women; one of our directors self-identifies as Black or African American; one of our directors self-identifies as Afro-Latino, and three of our directors self-identify as Asian. experience , and Hillman Solutions Corp. The Lauder family has direct and indirect holdings of approximately ” As noted above, effective as of November 18, 2022 (the date of our Annual Meeting of Stockholders), Ms. Tejada will leave the Audit Committee. Stock Plan Subcommittee). held in a virtual-only meeting format via live webcast. ” executive sessions of the Board of Directors our Board of Directors. In forwarded. TABLE OF CONTENTS “Agreements with Aerin ” As used in this Proxy Statement, the term The Company is required to pay all expenses (other than underwriting discounts and commissions of the selling stockholders, taxes payable by the selling stockholders, and the fees and expenses of the selling ” Under the Creative Consultant Agreement, Aerin Lauder, ELI launched AERIN Beauty in September 2012 with several products, and additional products have been introduced since then. ELI may launch additional 2022. At June 30, 2022, such entities had approximately $915,000 deposited with the Company to cover expenses. The Presiding Director receives an additional annual cash retainer of $30,000, payable quarterly, which may be deferred as explained below. guidelines. The Nominating and ESG Committee has engaged Semler Brossy Consulting Group, LLC (“Semler Brossy”) to assess trends and developments in director compensation practices and assist the committee in fulfilling its responsibilities regarding compensation of directors for service on the Company’s Board and its committees. Semler Brossy’s work for the Committee includes a competitive benchmarking of director compensation practices, referencing the same peer group used for the Company’s executive compensation analysis, as set forth in the Compensation Discussion and Analysis. The Nominating and ESG Committee determined that Semler Brossy is free of conflicts of interest. Name Charlene Barshefsky Rose Marie Bravo Wei Sun Christianson Paul J. Fribourg Mellody Hobson Irvine O. Hockaday, Jr. Richard D. Parsons Lynn Forester de Rothschild Barry S. Sternlicht Richard F. Zannino Rose Marie Bravo Rose Marie Bravo Name of Beneficial Owner Leonard A. Lauder(3)(4) LAL Family Corporation(3)(5) Ronald S. Lauder(3)(6) William P. Lauder(3)(7) Gary M. Lauder(3)(8) Aerin Lauder(3)(9) Jane Lauder(3)(10) Joel S. Ehrenkranz, as trustee(3)(11) Richard D. Parsons, individually and as trustee(3)(12) Carol S. Boulanger, individually and as trustee(3)(13) Charlene Barshefsky(14) Rose Marie Bravo(15) Wei Sun Christianson(16) Paul J. Fribourg(17) Mellody Hobson(18) Irvine O. Hockaday, Jr.(19) Lynn Forester de Rothschild(20) Barry S. Sternlicht(21) Richard F. Zannino(22) Fabrizio Freda(23) John Demsey(24) Cedric Prouvé(25) Tracey T. Travis(26) BlackRock, Inc.(27) FMR LLC(28) The Vanguard Group(29) All directors and executive officers as a group (23 persons)(30) Financial Measure Net Sales Net Sales as adjusted(1) Net Sales as adjusted in constant currency(1) Operating Margin Operating Margin as adjusted(1) Diluted EPS Diluted EPS as adjusted(1) Diluted EPS as adjusted in constant currency(1) Return on Invested Capital(2) Cash Flow from Operations Total Stockholder Return ("TSR") TSR – S&P 500 Composite From time to time, we discuss various topics, including executive compensation, social impact and sustainability, and corporate governance matters, with investors and other stakeholders. Practices: Employment agreements in effect during fiscal Elements of Compensation 80% Corporate Multiplier floor in the plan design) and (ii) overall payouts ranging from 114.5% to 135.6% (therefore, no impact from the 50% overall payout floor in the fiscal 2022 plan design). Based on target levels for incentive compensation for fiscal We Align Executive Compensation with Our Business Strategy and Goals. We intend for our annual and long-term incentive plans to cover a portfolio of performance measures that balance growth, profitability, and stockholder return over both an annual and long-term period. We work to establish goals that support the long-term strategy of growing sales at least 1% We assess global macro-economic risks to prudently plan activities in business units that are currently over-attaining goals and to challenge business units that are lagging net sales and profit objectives. We carefully plan to drive sustained, profitable sales growth over the long-term horizon. We do this by strategically planning category and subcategory innovation and extending consumer reach by pivoting to channels (e.g., online) to help enable net sales and profit growth. these goals are also intended to help us reduce cost and waste. “Elements of Compensation” above for a chart that shows the design of the fiscal 2022 and fiscal 2023 EAIP and PSU. DECIEM. Corporate Multiplier. Diluted EPS OI Margin Percent Net Sales ROIC(2) Corporate Multiplier Net Sales John Demsey Cedric Prouvé NOP Margin John Demsey Cedric Prouvé Inventory Management – Days to Sell John Demsey Cedric Prouvé Inventory Management – Days of Supply John Demsey Cedric Prouvé Inventory Management – Weighted Forecast Accuracy John Demsey Cedric Prouvé Productivity – Employee Costs John Demsey Cedric Prouvé Productivity – Employee Costs as % of Net Sales John Demsey Cedric Prouvé Unit Strategic Objectives Calculation of EAIP Payout Percentage. As noted, the weightings of the various criteria for an executive Global Brands Results Functions Average Business Unit Strategic Objectives Division Net Sales(1) Division NOP Margin(1) Inventory Management Productivity Business Unit Payout (a) Corporate Multiplier (b) EAIP Payout % (a) x (b) Subcommittee (or the Committee for non-equity-based compensation), its outside consultant, and management take into account the level of responsibility of the particular executive officer, recent performance and expected future contributions, internal pay equity, and competitive practice. They also consider applicable employment agreements as necessary. PSUs are accompanied by dividend equivalent rights that will be payable in cash at the time of payout of the related shares, and such awards do not have any voting rights with respect to the underlying shares of Class A Common Stock. PSUs are subject to restrictions on transfer and forfeiture prior to vesting, and upon payout of such awards, shares will be withheld to satisfy statutory tax obligations. Payout of annual PSUs generally assumes continued employment and is subject to acceleration upon the occurrence of certain events as described in “Potential Payments upon Termination of Employment or Change of Control – Events of Termination under the Employment Agreements and under the Share Incentive Plan.” ” For the fiscal 2020 PSUs, Net Sales (CAGR)(1) Diluted EPS (CAGR) ROIC (CAGR) Aggregate Payout Net Sales (CAGR)(1) Diluted EPS (CAGR) ROIC (CAGR)(3) set. 2025, this award will be forfeited. date assuming continued employment and subject to acceleration upon the occurrence of certain events as described in “Potential Payments upon Termination of Employment or Change of Control – Events of Termination under the Employment Agreements and under the Share Incentive Plan.” Stock options do not have dividend equivalent rights or any voting rights with respect to the underlying shares of Class A Common Stock. The vesting of RSUs is subject to continued employment and subject to acceleration upon the occurrence of certain events as described in “Potential Payments upon Termination of Employment or Change of Control – Events of Termination under the Employment Agreements and under the Share Incentive Plan.” RSUs are subject to restrictions on transfer and forfeiture prior to vesting. Upon payout, shares will be withheld to satisfy statutory tax obligations. longer term. ” For fiscal 2022, Mr. Option grants. Fiscal Year 2017 2016 2015 Fiscal The intention of these non-annual awards is, in part, to motivate Mr. Freda’s long-term stewardship of the Company and, as reflected below, the structure of these awards in fiscal 2021, fiscal 2018, and fiscal 2016 is such that there is a moderate overlap in the vesting and performance periods between awards. The shares of Class A Common Stock underlying the March 2021 PVU and PSU Grants are not intended to be delivered to Mr. Freda until after the end of fiscal 2025, which reflects the Company’s desire to further align his interests with those of our stockholders over that extended period of time. Between the time that Mr. Freda became CEO (July 2009) and the end of fiscal 2022 (June 30, 2022), (i) the Company achieved TSR of 1,702% (the TSR of the S&P 500 Index was 433%); and (ii) our market capitalization increased $85 billion, from $6 billion to $91 billion. As referenced below, “Performance Period” is the period of time over which the attainment of one or more Performance Goals will be measured for the purpose of determining any payouts to Mr. Freda under the relevant award, and “Service Period” is the period of time that Mr. Freda must be employed by the Company in order to receive any payout under the relevant award. For fiscal These grants reflect the application of an individual performance factor to the target equity opportunity approved for fiscal 2023. These grants reflect the application of an individual performance factor to the target equity opportunity approved for fiscal 2023. fiscal 2023. compensation in fiscal 2022. Our revenues approximate the 2022. the Company in fiscal 2022. ” In addition, beginning in fiscal 2023, the employee healthcare coverage provided by the Company for Mr. Freda has been expanded to provide full coverage outside the United States, and in connection with this new coverage in fiscal 2023, Mr. Freda will no longer receive payment in lieu of a medical reimbursement program. obtain a limited amount of our products for free or at a discount. ” In addition, certain executive officers who joined us mid-career, or who forfeited certain retirement benefits from their former employers to join us, have been provided with nonqualified supplemental pension arrangements. 2022.” ” Mr. Freda deductible. Requirements Under these guidelines, each executive officer is required to An executive officer who commences employment with the Company or who is promoted from within the Company has until the fifth anniversary of the date of employment or effective date of promotion to comply with these guidelines. Pledging Policy Company’s Executive Stock Ownership Guidelines). William P. Lauder Executive Chairman Fabrizio Freda(1) President and Chief Executive Officer Tracey T. Travis(2) Executive Vice President and Chief Financial Officer John Demsey(3) Executive Group President Cedric Prouvé Group President – International September 6, 2016 (fiscal 2017) September 4, 2015 (fiscal 2016) September 3, 2014 (fiscal 2015) Fabrizio Freda. Under his employment agreement effective July 1, 2011, Mr. Freda is an employee-at-will, and he will continue as President and Chief Executive Officer until his retirement or other termination of his employment. The agreement provides that his base salary and bonus opportunities will be set by the Compensation Committee and that his equity grants will be determined by the Subcommittee. In addition to benefits generally available to senior executives (e.g., annual perquisite reimbursement under our Executive Perquisite Plan of up to $20,000, financial counseling services up to $5,000, and participation in the Mr. Freda’s employment agreement requires the Company to make certain post-termination payments and continue certain benefits during the enforced non-compete period in such agreement. Under his employment agreement effective July 1, 2010, Mr. Demsey was an employee-at-will, and served as Group President until his retirement on March 4, 2022. The agreement provided for a base salary and bonus opportunities to be set by the Compensation Committee and for equity grants as determined by the Subcommittee. In addition to the benefits generally available to our senior executives (e.g., annual perquisite reimbursement under our Executive Perquisite Plan up to $15,000, financial counseling services up to $5,000, and participation in our Executive Automobile Program with an automobile having an acquisition value of $50,000), we provided annual premiums for additional executive term life insurance with a face amount of $5 million for Mr. Demsey. We also provided travel expenses for his spouse/companion or domestic partner to accompany him on up to two business-related travel itineraries per fiscal year. See additional information in “Compensation Discussion and Analysis – Retirement of Named Executive Officers (John Demsey and Cedric Prouvé)” and “Potential Payments Upon Termination of Employment or Change of Control – Retirement of John Demsey.” certain circumstances, for two years following termination of employment, (c) provides that the executive must abide by restrictive covenants regarding non-disclosure of our confidential information, (d) provides that the executive may elect to defer all or part of his or her annual incentive bonus compensation in compliance with Section 409A of the Internal Revenue Code (“Section 409A”), and (e) provides that benefits under the agreement may be modified by the Compensation Committee at any time other than in contemplation of a 2022 2022 William P. Lauder Fabrizio Freda Tracey T. Travis John Demsey Cedric Prouvé 2022 William P. Lauder Fabrizio Freda Tracey T. Travis John Demsey Cedric Prouvé Restoration Plan is payable in accordance with the terms of the plan, and as applicable, in compliance with Section 409A. Set forth in the table below William P. Lauder RGA Plan Restoration Plan Fabrizio Freda RGA Plan Restoration Plan Employment Agreement Tracey T. Travis RGA Plan Restoration Plan John Demsey RGA Plan Restoration Plan Cedric Prouvé RGA Plan Restoration Plan Nonqualified Deferred Compensation in Fiscal 2022 William P. Lauder Fabrizio Freda Tracey T. Travis John Demsey Cedric Prouvé Also, Mr. Freda is not eligible for such payment as explained in “Compensation Discussion and Analysis – Other Benefits and Perquisites – Benefits.” Additionally, upon retirement, the NEOs, except for Mr. Freda and Ms. Travis, are entitled to life-time annual supplemental payments in connection with healthcare benefits. (i) the one-year anniversary of the date of death or termination by reason of disability and (ii) June 30, 2024, and the delivery of shares, if any, would be made shortly thereafter. As reflected in “Compensation Discussion and Analysis – Additional (non-annual) Performance-Based Long-Term Equity Grants to CEO in Fiscal 2016, Fiscal 2018, and Fiscal 2021 – Price-Vested Units granted in March 2021,” each of the three Stock Price Goals has been achieved for the non-annual March 2021 PVU. In connection with the non-annual February 2018 PSU, if Mr. Freda dies or becomes disabled, then for each Performance Period that has not yet concluded, he will earn and vest in a pro rata portion of such tranche, and the share payment would be made shortly thereafter. For annual PSU grants made in September 2020 and later, such grants will be paid at target if an executive’s death occurs prior to the end of the Award Period. If such termination occurs after the end of the Award Period, the PSU will be paid based on actual achievement. For provisions regarding termination of employment upon death with regard to the non-annual PVUs and PSUs granted to Mr. Freda, see “Compensation Discussion and Analysis – CEO Compensation.” See “Compensation Discussion and Analysis – CEO Compensation” for information about the treatment of Mr. Freda’s additional (non-annual) PVU and PSU grants upon termination of employment. For purposes of the employment agreements, a For information about the treatment of Mr. Freda’s additional (non-annual) PVU and PSU grants upon a Change in Control, see “Compensation Discussion and Analysis – CEO Compensation.” abuse that materially affects performance, or conviction of, or entry of a guilty plea or no contest for, a felony. separation from service. 2022. Payments and other benefits for Mr. Demsey and Mr. Prouvé, who retired on March 4, 2022 and June 30, 2022, respectively, are discussed above. See “Potential Payments Upon Termination of Employment or Change in Control – Retirement of Cedric Prouvé” and “Potential Payments Upon Termination of Employment or Change in Control – Retirement of John Demsey.” William P. Lauder Base Salary Bonus Options PSU RSU Continued Health Care Benefits(1) Continued Participation in Pension and Retirement Plans(2) Other Benefits and Perquisites(3) Total Fabrizio Freda Base Salary Bonus Options PSU RSU Continued Health Care Benefits(1) Continued Participation in Pension and Retirement Plans(2) Other Benefits and Perquisites(3) Total Tracey T. Travis Base Salary Bonus Options PSU RSU Continued Health Care Benefits(1) Continued Participation in Pension and Retirement Plans(2) Other Benefits and Perquisites(3) Total John Demsey Base Salary Bonus Options PSU RSU Continued Health Care Benefits(1) Continued Participation in Pension and Retirement Plans(2) Other Benefits and Perquisites(3) Total Cedric Prouvé Base Salary Bonus Options PSU RSU Continued Health Care Benefits(1) Continued Participation in Pension and Retirement Plans(2) Other Benefits and Perquisites(3) Total PwC. SEC. 2020. One or more representatives of PwC is expected to be present at the Annual Meeting of Stockholders, will have an opportunity to make a statement, if any such representative desires to do so, and is expected to be available to respond to appropriate questions. Audit Fees(1) Audit-Related Fees(2) Tax Fees(3) All Other Fees Total services and certain audit services, which services are subsequently reported to and approved by the ” The Financial Measure Net Sales as reported Accelerated orders associated with SMI rollout Returns associated with restructuring and other activities Net Sales as adjusted Operating Margin as reported Accelerated orders associated with SMI rollout Goodwill and other intangible asset impairments Changes in fair value of contingent consideration Venezuela remeasurement charges Returns and charges associated with restructuring and other activities Operating Margin as adjusted Diluted EPS as reported Accelerated orders associated with SMI rollout Goodwill and other intangible asset impairments Changes in fair value of contingent consideration China deferred tax asset valuation allowance reversal Venezuela remeasuement charges Returns and charges associated with restructuring and other activities Diluted EPS as adjusted Return on Invested Capital, as reported Return on Invested Capital, as adjusted(2)

767 Fifth Avenue

New York, New York 10153NOTICE OF ANNUAL MEETING OF STOCKHOLDERSDate and Time:Tuesday,![[MISSING IMAGE: lg_esteelaudercom-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/lg_esteelaudercom-pn.jpg)

14, 2017 at18, 2022local timePlace:JW Marriott Essex House New YorkGrand Salon160 Central Park SouthNew York, New York 10019Items of Business:1.the fivesix Class III director nomineesII Director Nominees as directorsDirectors to serve until the 20202025 Annual Meeting of Stockholders;2.Committee'sCommittee’s appointment of KPMGPricewaterhouseCoopers LLP as independent auditors for the 20182023 fiscal year; and3.compensation; and4.To provide an advisory vote on the frequency of the advisory vote on executive compensation. By Order of the Board of Directors

SPENCER G. SMUL

Senior Vice President,

Deputy General Counsel and Secretary

New York, New York

September 28, 2017

29, 2022 20172022 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 14, 2017:18, 2022: The Company'sCompany’s Proxy Statement for the 20172022 Annual Meeting of Stockholders and the Annual Report to Stockholderson Form 10-K for the fiscal year ended June 30, 20172022 with certain exhibits (which constitutes the “Annual Report to Stockholders”) are available atwww.proxyvote.comwww.envisionreports.com/EL.. 1 45 89 89 89 910 1113 1416 1718 1718 Board Committees 1718 18 1920 1920 1921 21 23 2023 2023 2023 2124 2225 2225 2225 Section 16(a) Beneficial Ownership Reporting Compliance 2326 2326 2831 3235 40 40 5969 6070 6373 6576 6778 7081 7182 7383 7384 93 8195 8296 8498 ADVISORY VOTE ON THE FREQUENCY OF THE ADVISORY VOTE ON EXECUTIVE COMPENSATION (Item 4) 8699 8699 87100 A-1 PROXY STATEMENT SUMMARY 2017 Annual Meeting of StockholdersDate and Time:Tuesday, November 14, 2017 at 10:00 a.m.Place:JW Marriott Essex House New YorkGrand Salon160 Central Park SouthNew York, New York 10019Record Date:September 15, 2017Items of BusinessBoardRecommendationProxy StatementDisclosure 1.Election of Class III DirectorsFOReach director nomineePage 82.Ratification of Appointment of KPMG LLP as Independent AuditorsFORPage 823.Advisory Vote to Approve Executive CompensationFORPage 844.Advisory Vote on the Frequency of the Advisory Vote on Executive CompensationONE YEARPage 85 The following table provides information about the Class III Director Nominees standing for election to serve until the 2020 Annual Meeting of Stockholders. Information about all the Directors can be found in this Proxy Statement beginning on page 8.NomineeCurrent PositionCommittee Membership Charlene BarshefskySenior International Partner, WilmerHaleNominating and Board Affairs CommitteeWei Sun ChristiansonManaging Director and Co-Chief Executive Officer of Asia Pacific and Chief Executive Officer of China, Morgan StanleyNominating and Board Affairs CommitteeFabrizio FredaPresident and Chief Executive Officer, The Estée Lauder Companies Inc.NoneJane LauderGlobal Brand President, CliniqueNoneLeonard A. LauderChairman Emeritus, The Estée Lauder Companies Inc.None As explained in the "Compensation Discussion and Analysis," we drive our annual and long-term performance through our executive compensation programs. Annual incentive pay is tied to business objectives that are specific to each individual's responsibilities and encourage collaboration across the organization. Long-term equity incentives are tied to both the Company's share price and financial goals over a period of three or more years. This combination of compensation elements is intended to support and promote strong, balanced, and sustainable corporate performance. Our fiscal 2017 results reflect our success in pivoting our business to the fastest-growing areas of prestige beauty to align with consumers' changing shopping preferences. With our leading brands, quality innovations, and the acquisitions of Too Faced and BECCA, we attracted new consumers globally. Our business accelerated in our online direct-to-consumer and retailer e-commerce sites, as well as in the travel retail and specialty-multi channels. In addition, we built momentum in key geographies, like China and Italy, aided by enhanced digital and social media communications, and we began to further improve our organizational efficiency and effectiveness through our Leading Beauty Forward initiative. Importantly, we delivered this performance in the face of external global volatility.Fiscal 2017 Change over

Prior Year3-Year

Compound Annual

Growth Rate

(or Basis Point

Improvement)5-Year

Compound Annual

Growth Rate

(or Basis Point

Improvement) $11.8 billion 5% 2.5% 4.0% $11.8 billion 5% 3.1% 4.0% $12.0 billion 7% N/A N/A 14.3% — –240bp +80bp 15.9% +30bp –20bp +170bp $3.35 13% 3.1% 9.2% $3.47 8% 5.6% 8.9% $3.59 11% N/A N/A 18.9% –350bp –590bp –510bp $1.8 billion 1% 5.5% 9.8% 7.1% — 10.4% 13.7% 17.9% — 9.6% 14.6% (1)All periods have been adjusted to exclude returns and charges associated with restructuring and other activities. Fiscal 2017 has also been adjusted to exclude goodwill and other intangible asset impairments and, for Diluted EPS as adjusted, to exclude the China deferred tax asset valuation allowance reversal. Fiscal 2017 and fiscal 2016 have also been adjusted to exclude the impact of changes in the fair value of contingent consideration. Fiscal 2014 has also been adjusted for a charge to remeasure net monetary assets in Venezuela and for the impact of the accelerated orders associated with the Company's July 2014 implementation of its Strategic Modernization Initiative. Fiscal 2017 Net Sales as adjusted in constant currency excludes the $187 million negative impact of foreign currency translation. Fiscal 2017 Diluted EPS as adjusted in constant currency excludes the $0.12 impact of foreign currency translation. See Appendix A for reconciliation and other information about these non-GAAP financial measures.(2)Excludes returns and charges associated with restructuring and other activities and the impact of changes in the fair value of contingent consideration in each period, where applicable. Fiscal 2017 also excludes goodwill and other intangible asset impairments. The lower ROIC in fiscal 2017 as compared with prior periods was primarily attributable to the impact of our fiscal 2017acquisitions, higher levels of reported cash and short- and long-term investments from earnings generated by our international operations, and the unfavorable impact of foreign currencies. See Appendix A for information about this non-GAAP financial measure. In fiscal 2017, we increased the common stock dividend 13%, repurchased 4.7 million shares for $413 million, and used $504 million of cash flow from operations for capital expenditures. Over the five-year period ended June 30, 2017, the total market value of the Company increased by 68% or approximately $14.3 billion. Executive Compensation Highlights The following summarizes key executive compensation decisions that affected compensation in, or relating to, fiscal 2017:•The Compensation Committee authorized increases in annual compensation for fiscal 2017 for the President and Chief Executive Officer and certain other Named Executive Officers ("NEOs") in recognition of strong and sustained individual and Company performance. On average, fiscal 2017 annual target compensation for the NEOs increased less than 5%.•The annual stock-based compensation awarded to our NEOs in fiscal 2017 was based on target grant levels and an assessment of each officer's performance and expected future contributions. The current equity mix is weighted equally among performance share units ("PSUs"), stock options, and restricted stock units ("RSUs").•The base salary for Fabrizio Freda, our President and Chief Executive Officer, remained at $1.9 million, his bonus opportunity remained at $4.7 million, and his equity target was increased to $8.5 million, resulting in target total annual compensation of $15.1 million for fiscal 2017, an increase of 4% from fiscal 2016. No additional equity grants were made to Mr. Freda in fiscal 2017, which accounts for the significant year-over-year declines shown for "Stock Awards" and "Total" in the "Summary Compensation Table."•In August 2017, the Stock Plan Subcommittee approved the payout for the third (final) tranche of the PSU granted to Mr. Freda in September 2012 that was based on Total Stockholder Return ("TSR"). Target payout was set at the 60th percentile, a rigorous objective. The Company's TSR during the performance period relative to that of the S&P 500 Companies was at the 46th percentile. Accordingly, Mr. Freda received 30,267 shares under this incentive award.•Based on the Company's performance over the three-year period ended June 30, 2017, the PSUs granted to our executive officers in September 2014 resulted in an aggregate payout of 81.3% of target.•Our NEOs achieved fiscal 2017 payout percentages under the Executive Annual Incentive Plan ranging from 110% to 131% out of a possible maximum of 150% of target bonus opportunities. For more complete information about our executive compensation philosophy and approach, please see additional information below in "Executive Compensation" including "Compensation Discussion and Analysis."THE ESTÉE LAUDER COMPANIES INC.767 Fifth AvenueNew York, New York 10153PROXY STATEMENTFOR ANNUAL MEETING OF STOCKHOLDERSTO BE HELD NOVEMBER 14, 2017September 28, 2017Annual Meeting and voting This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors of The Estée Lauder Companies Inc. (the "Company," "we," or "us"), a Delaware corporation, to be voted at the Annual Meeting of Stockholders to be held in the Grand Salon at the JW Marriott Essex House New York, 160 Central Park South, New York, New York, 10019 on Tuesday, November 14, 2017, at 10:00 a.m., local time, and at any adjournment or postponement of the meeting. The approximate date on which this Proxy Statement and form of proxy are first being provided to stockholders, or being made available through the Internet for those stockholders receiving their proxy materials electronically, is September 28, 2017.Admission29, 2022. Date and Time: Friday, November 18, 2022 10:00 a.m., Eastern Time Place: Record Date: September 19, 2022 ITEMS OF BUSINESS

RECOMMENDATION

STATEMENT DISCLOSURE Election of Class II Directors Ratification of Appointment of PricewaterhouseCoopers LLP as Independent Auditors Advisory Vote to Approve Executive Compensation meeting will require a ticket. If you are a stockholder2025 Annual Meeting of recordStockholders, reflecting committee assignments as of the Record Date. Additional information about all the Directors can be found in this Proxy Statement. See “Election of Directors.” Nominee Current Position Committee Membership Ronald S. Lauder Chairman of Clinique Laboratories LLC None William P. Lauder Executive Chairman of The Estée Lauder Companies Inc. Nominating and ESG Committee Richard D. Parsons Senior Advisor to Providence Equity Partners LLC; and Co-founder and Partner of Imagination Capital LLC Compensation Committee; and Nominating and ESG Committee Lynn Forester de Rothschild Co-founding partner of Inclusive Capital Partners; and Chair of E.L. Rothschild LLC Nominating and ESG Committee Jennifer Tejada Chief Executive Officer and Chair of the Board, PagerDuty, Inc. Audit Committee Richard F. Zannino Managing Director, CCMP Capital Advisors LLC Audit Committee (Chair); and Compensation Committee and Stock Plan Subcommittee ![]()

CEO Annual Compensation

for Fiscal 2022 Payout of Second Tranche of September 2015 PSU

granted to CEO Certification of Performance

Goal for Second (final) Tranche

of February 2018 PSU

granted to CEO NEO Annual Stock-Based Compensation for Fiscal 2022 Payout of PSUs granted to

NEOs in Fiscal 2020 EAIP Payout for NEOs

for Fiscal 2022 ![]()

767 Fifth Avenue

New York, New York 10153

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD NOVEMBER 18, 2022plan to attend, please checkVotingappropriate boxsolicitation of proxies on behalf of the proxy card, or so indicate when you vote by telephone or Internet, and an admission ticket will be mailed to you. Please bring photo identification, as well as your admission ticket, if you attend the meeting. If you are a stockholder whose shares are held through an intermediary, such as a bank or broker, and you plan to attend, please request an admission ticket by writing to the Investor Relations Department atBoard of Directors of The Estée Lauder Companies Inc. (the “Company,” “we,” or “us”), 767 Fifth Avenue, New York, New York 10153. Evidencea Delaware corporation, to be voted at the Annual Meeting of your ownershipStockholders to be held in a virtual-only meeting format via live webcast on Friday, November 18, 2022, at 10:00 a.m., Eastern Time, and at any adjournment or postponement of sharesthe meeting.ourClass A Common Stock holding shares at the close of business on September 15, 201719, 2022 (the "Record Date"“Record Date”), which you may attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/EL2022 and logging in with the 16-digit control number found on your proxy card, voting instruction form, or Notice of Internet Availability of Proxy Materials (the “Notice”), as applicable. If you do not have your 16-digit control number or are not a stockholder, you will be able to register as a guest to view the live webcast by visiting the website referenced in this paragraph; however, you will not be able to vote or submit questions during the meeting. You may log into www.virtualshareholdermeeting.com/EL2022 beginning at 9:45 a.m., Eastern Time, on November 18, 2022. The Annual Meeting will begin promptly at 10:00 a.m., Eastern Time.obtain fromI ask a question during the Annual Meeting?bank, broker, or other intermediary, must accompany your letter.August 31, 2017,the Record Date, there were 225,115,277231,546,267 shares of Class A Common Stock and 143,419,528125,542,029 shares of Class B Common Stock issued and outstanding."SEC"“SEC”), we have elected to furnish to our stockholders this Proxy Statement and our Fiscal 2017 Annual Report to Stockholders by providing access to these documents on the Internet rather than mailing printed copies. Accordingly, athe Notice of Internet Availability of Proxy Materials (the "Notice") is being mailed to our stockholders of record and beneficial owners (other ![]()

Company'sCompany’s transfer agent, Computershare, Inc., or you have a physical stock certificate), you can vote your shares in one of twothe following ways: either by proxy or in person at(i) prior to the Annual Meeting. Ifmeeting, you choose to vote by proxy, you may do so by usingcan use the Internet via www.proxyvote.com and follow the instructions; (ii) if you received a proxy card, you can return the proxy card via mail in the postage paid envelope provided for that purpose; (iii) by telephone; or (iv) by following the telephone, orinstructions provided on the Notice, and by requesting a printed copy of our proxy materials and completing and returning by mail the proxy card you receive in response to your request.14, 2017.18, 2022. If you submit a proxy without giving instructions, your shares will be voted as recommended by the Board of Directors."street name"?"street name"“street name”), you are invited to attendon the Annual Meeting. However, since you are not a stockholderday of record, you may not vote these shares in person at the Annual Meeting, unless you bring with you a legalmay go to www.virtualshareholdermeeting.com/EL2022, and log in by entering the 16-digit control number found on your proxy from the stockholder of record. A legal proxy may be obtained from your broker, bank,card, voting instruction form, or nominee.wishhave your control number, you will be able register as a guest; however, you will not be able to vote in person or submit questions during the meeting.KPMGPricewaterhouseCoopers LLP (Item 2)."street name"“street name” holders:You must instruct your broker if you want your shares to be counted in the election of directors at the Annual Meeting (Item 1), and the advisory vote to approve executive compensation (Item 3), and the advisory vote on the frequency of the advisory vote on executive compensation (Item 4). New York Stock Exchange ("NYSE"(“NYSE”) rules prevent your broker from voting your shares on these matters without your instructions. Please follow the instructions provided by your broker so that your vote can be counted. or by voting in person at the Annual Meeting.. The mailing address of our principal executive offices is 767 Fifth Avenue, New York, New York 10153. ![]()

The following table notes for each proposal: (i) the vote required of Class A Common Stock and Class B Common Stock (voting together) for approval; (ii) whether abstentions count as votes cast; and (iii) whether broker discretionary voting is allowed. Proposal ProposalVote required for approval

(Class A and Class B

Common Stock, voting together)

Do abstentions

count asas votes cast?

Is broker

discretionary

voting allowed?

Election of Class IIIII

Directors

Plurality of Votes Cast* Not Applicable No Item 2:

Ratify approvalappointment of PricewaterhouseCoopers LLPKPMG LLP's appointmentas independent auditors Majority of Votes Cast No Yes Item 3:

Advisory vote to approveapprove Executive Compensation

Majority of Votes Cast** No NoItem 4:Advisory vote on the frequency ofthe advisory vote on ExecutiveCompensationMajority of Votes Cast*** No Nonominee'snominee’s achievement of a plurality.Company'sCompany’s executive compensation program, value the opinions expressed by stockholders. See "Compensation“Compensation Discussion and Analysis – Advisory Vote on Executive Compensation."***The advisory vote on the frequency of the advisory vote on executive compensation (Item 4) is not binding on the Company. If none of the choices on the frequency vote receives a majority of the votes cast, the choice that receives the most number of votes will be considered to be the result of this advisory vote.KPMGPricewaterhouseCoopers LLP (Item 2) and the advisory vote to approve executive compensation (Item 3), stockholders may vote in favor of the proposal, may vote against the proposal, or may abstain from voting. For the advisory vote on the frequency of the advisory vote on executive compensation (Item 4), stockholders may vote for one year, two years, three years, or may abstain from voting. Stockholders should specify their choices on the proxy card or pursuant to the instructions thereon for telephone or Internet voting. If no specific choices are indicated, the shares represented by a properly submitted proxy will be voted:2.KPMGPricewaterhouseCoopers LLP as independent auditors; and ![]()

compensation; and4.FOR ONE YEAR on the frequency of the advisory vote on executive compensation.Computershare,Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election. Aas ofentitled to vote at the close of business on the Record Datemeeting will be available for examination by any stockholder, for any purpose germane to the Annual Meeting. This list will be available during such meeting and during normal business hours from October 31, 2017 through November 13, 2017,Meeting, by appointment, at the office of Spencer G. Smul, Senior Vice President, Deputy General Counsel and Secretary of the Company, at 767 Fifth Avenue, New York, New York 10153.and Form 10-Kto Stockholders on the Internet?Fiscal 2017 Annual Report to Stockholders are available atwww.envisionreports.com/EL. These proxy materials are also available, along with theour Annual Report on Form 10-K for the fiscal year ended June 30, 2017,2022 with certain exhibits (which constitutes the “Annual Report to Stockholders”) are available for stockholders at www.proxyvote.com."Investors"“Investors” section of our website atwww.elcompanies.comwww.elcompanies.com. Instead of receiving future copies of our Proxy Statement (including Notice of Annual Meeting) and Annual Report to Stockholders by mail, stockholders can access these materials online. Opting to receive your proxy materials online will save us the cost of producing and mailing documents to you; you will be provided with an electronic link to the proxy voting site.site will be provided to you. Stockholders of record can enroll atwww.proxyvote.comwww.computershare.com/investor for online access to future proxy materials. ![]()

Currently,fifteen directors.17 directors, including Arturo Nuñez, who was elected as a Class I director effective April 25, 2022, and Angela Wei Dong, who was elected as a Class III director effective July 11, 2022. The directors are divided into three classes, each serving for a period of three years.20172022 Annual Meeting of Stockholders are Charlene Barshefsky, Wei Sun Christianson, Fabrizio Freda, JaneRonald S. Lauder, William P. Lauder, Richard D. Parsons, Lynn Forester de Rothschild, Jennifer Tejada, and Leonard A. Lauder, eachRichard F. Zannino. Each of whomthese directors has been nominated to stand for re-election as a Class II director at the 20172022 Annual Meeting, to hold office until the 20202025 Annual Meeting and until his or her successor is elected and qualified. In the unanticipated event that one or more of thesethe nominees is unable or declines to serve for any reason, the Board may reduce the number of directors or take action to fill any vacancy.

Director Qualifications. Our Board is comprised of individuals with diverse and complementary business experience, leadership experience, and financial expertise.experience. Many of our directors have leadership experience at major domestic and multinational companies, as well as experience on the boards of other companies and organizations, which provideprovides an understanding of different business processes, challenges, and strategies. Other directors have government, legal, public policy, or media experience that provides insight into issues faced by public companies. The members of the Board are inquisitive and collaborative, challenging yet supportive, and demonstrate maturity and sound judgment in performing their duties. In addition to their own attributes, skills, and experience, and their significant personal investments in the Company, Lauder Family Members (including related entities) who control the Company have agreed to vote their shares in favor of four individuals as directors – Jane Lauder, Leonard A. Lauder, Ronald S. Lauder and William P. Lauder. The term "Lauder Family Members" is defined below (see "Certain Relationships and Related Transactions – Lauder Family Relationships and Compensation").Company'sCompany’s long-term strategy, monitor progress, and oversee management.group'sgroup’s diversity of experience, represent stockholder interests through the exercise of sound judgment. Such diversity of experience may be enhanced by a mix of different professional and personal backgrounds and experiences. The Company is proud to have a board that is highly diverse Board, including with respect to gender and race. ![]()

The Board recommends a vote FOR each nominee as a director to hold office until the 2020 Annual Meeting. Proxies received by the Board will be so voted unless a contrary choice is specified in the proxy. Ronald S. Lauder

FABRIZIO FREDADirector since 2009Age 60Mr. Freda has served as President and Chief Executive Officer of the Company since July 2009. From March 2008 through June 2009, he was President and Chief Operating Officer where he oversaw the Clinique, Bobbi Brown, La Mer, Jo Malone London, Aveda, and Bumble and bumble brands, and the Aramis and Designer Fragrances division. He also was responsible for the Company's International Division, as well as Global Operations, Research and Development, Packaging, Quality Assurance, Merchandise Design, Corporate Store Design, and Retail Store Operations. Prior to joining the Company, Mr. Freda served in a number of positions of increasing responsibility at The Procter & Gamble Company ("P&G"), where he was responsible for various operating, marketing, and key strategic efforts for over 20 years. From 2001 through 2007, Mr. Freda was President, Global Snacks, at P&G. He also spent more than a decade in the Health and Beauty Care division at P&G. From 1986 to 1988, Mr. Freda directed marketing and strategic planning for Gucci SpA. He is currently a member of the Board of Directors of BlackRock, Inc., a global asset management company.Qualifications:•Global management, marketing, and other business, consumer and luxury brand industry experience as President and Chief Executive Officer of The Estée Lauder Companies Inc.•Similar experience, including developing and leading global organizations, in leadership positions at P&G and Gucci SpA•Experience leading successful, creative organizations with innovation programs based on research and development•Board experience at BlackRock, Inc.•Experience living and working in several countries•Financial expertise

JANE LAUDERDirector since 2009Age 44Ms. Lauder has served as Global Brand President, Clinique, since April 2014. Immediately prior to that, she was Global President, General Manager of the Origins, Ojon, and Darphin brands. From July 2008 until July 2010, she was Senior Vice President/General Manager of the Origins brand. Ms. Lauder began her career with the Company in 1996 at Clinique and served in various positions throughout the Company until July 2006, when she became Senior Vice President, Global Marketing for Clinique.Qualifications:•Management, marketing and other industry experience through leadership roles at The Estée Lauder Companies Inc. since joining in 1996•Significant stockholder and party to Stockholders' Agreement (solely as trustee of one or more trusts)![[MISSING IMAGE: ph_ronaldslauder-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_ronaldslauder-bw.jpg)

PAUL J. FRIBOURGDirector since 2006Age 63Committees: Audit Committee, Compensation Committee, and Stock Plan SubcommitteeMr. Fribourg has been the Chairman and Chief Executive Officer of Continental Grain Company, an international agribusiness and investment company, since July 1997. He joined Continental Grain Company in 1976 and worked in various positions there with increasing responsibility in both the United States and Europe. Mr. Fribourg is on the boards of directors of Apollo Global Management, LLC, Loews Corporation, and Restaurant Brands International Inc. He also serves as a member of Rabobank's International North American Agribusiness Advisory Board, and as a board member and Executive Committee member of Castleton Commodities International LLC. He has been a member of the Council on Foreign Relations since 1985.Qualifications:•Global management, marketing, and other business experience as Chairman and Chief Executive Officer of Continental Grain Company•Board experience at Apollo Global Management, LLC, Loews Corporation, and Restaurant Brands International Inc.•Affiliation with leading business and public policy associations (Council on Foreign Relations)•Financial expertise

MELLODY HOBSONDirector since 2005Age 48Committee: Audit CommitteeMs. Hobson has been the President of Ariel Investments, LLC, a Chicago-based investment management firm and adviser to the mutual funds offered by the Ariel Investment Trust, since 2000, and she is also President and Director of its governing member, Ariel Capital Management Holdings, Inc. In addition, she serves as President and Chairman of the Board of Trustees of the Ariel Investment Trust, a registered investment company. Ms. Hobson is a member of the Board of Directors of Starbucks Corporation. Additionally, within the past five years, she served as a director of DreamWorks Animation SKG, Inc. and Groupon, Inc. Ms. Hobson works with a variety of civic and professional institutions, including serving as Chairman of After School Matters, as a board member of the Chicago Public Education Fund, and as Emeritus Trustee of the Sundance Institute.Qualifications:•Management and investment experience as President of Ariel Investments, LLC•Board experience at DreamWorks Animation SKG, Inc., Groupon, Inc., and Starbucks Corporation•Media experience as on-air regular contributor and analyst on finance, the markets, and economic trends for CBS News•Financial expertise

IRVINE O. HOCKADAY, JR.Director since 2001Age 81Presiding DirectorCommittee: Audit Committee (Chair)Mr. Hockaday is the former President and Chief Executive Officer of Hallmark Cards, Inc. He retired in December 2001. Prior to joining Hallmark in 1983, he was President and Chief Executive Officer of Kansas City Southern Industries, Inc. Mr. Hockaday was a member of the Hallmark Board of Directors from 1978 until January 2002. He is currently a member of the Board of Directors of Aratana Therapeutics, Inc. Additionally, within the past five years, Mr. Hockaday served as a director of Crown Media Holdings, Inc. and Ford Motor Company.Qualifications:•Global business experience and consumer brand industry experience as former CEO of Hallmark Cards, Inc.•Board experience at numerous public companies, including Aratana Therapeutics, Inc., Crown Media Holdings, Inc., Ford Motor Company, and Sprint Nextel•Financial expertise•Legal experience

BARRY S. STERNLICHTDirector since 2004Age 56Committee: Nominating and Board Affairs CommitteeMr. Sternlicht is Chairman and Chief Executive Officer of Starwood Capital Group, the private investment firm he formed in 1991 that is focused on global real estate, hotel management, oil and gas, energy infrastructure, and securities trading. He also serves as Chairman and CEO of Starwood Property Trust, Inc., a commercial mortgage REIT. Mr. Sternlicht is a member of the Board of Directors of A.S. Roma, Chairman of the Board of Baccarat S.A. and Co-Chairman of the Board of Colony Starwood Homes. Additionally, within the past five years, Mr. Sternlicht served as a director of Restoration Hardware Holdings, Inc., Riviera Holdings Corporation, and TRI Pointe Group, Inc. (formerly TRI Pointe Homes, Inc.). From 1995 through early 2005, Mr. Sternlicht was Chairman and CEO of Starwood Hotels & Resorts Worldwide, Inc., a company he founded in 1995. He currently serves as a member of the board of The Robin Hood Foundation, and he is on the board of the Dreamland Film & Performing Arts Center and the Executive Advisory Board of Americans for the Arts. Mr. Sternlicht is a trustee of Brown University and serves on the boards of numerous other civic organizations and charities.Qualifications:•Global business, investment, real estate, financial, private equity, entrepreneurial, and consumer brand and luxury industry expertise at Starwood Capital Group, as Chairman of Starwood Property Trust, Inc., and as founder and former Chief Executive of Starwood Hotels & Resorts Worldwide, Inc.•Board experience at A.S. Roma, Baccarat S.A., Colony Starwood Homes, Restoration Hardware Holdings, Inc., Starwood Property Trust, Inc., and TRI Pointe Group, Inc.•Trustee of Brown University•Financial expertise ![]()

Richard D. Parsons

RICHARD D. PARSONS![[MISSING IMAGE: ph_richarddparsons-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_richarddparsons-bw.jpg)

Age 6974

Class II (Chair) and Board AffairsESG Committee firm, since 2009.firm. Mr. Parsons is a co-founder and partner of Imagination Capital LLC, a venture capital firm. From 1996 until 2012, he was a director of Citigroup Inc. and served as its Chairman from February 2009 to April 2012. From May 2003 until his retirement in December 2008, Mr. Parsons served as Chairman of the Board of Time Warner Inc. From May 2002 until December 2007, he served as Chief Executive Officer of Time Warner Inc. From January 2001 until May 2002, Mr. Parsons was Co-Chief Operating Officer of AOL Time Warner. From 1995 until the merger with America On-Line Inc., he was President of Time Warner Inc. From 1990 through 1994, he was Chairman and Chief Executive Officer of Dime Bancorp, Inc. Mr. Parsons is currently a member ofon the boards of directors of Group Nine Acquisition Corp., Lazard Ltd., and The Madison Square Garden Company. Among his numerous community activities,Sports Corp. Additionally, within the past five years, he isserved as a director of CBS Corporation. Mr. Parsons currently serves as Chairman of the Apollo Theatre Foundation and the Jazz Foundation of America.Qualifications: The Madison Square Garden Company,Sports Corp., and Time Warner Inc.expertiseexperience

Lynn Forester de Rothschild

LYNN FORESTER DE ROTHSCHILD ![[MISSING IMAGE: ph_lynnfderothschild-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_lynnfderothschild-bw.jpg)

Age 6368

Class IIBoard AffairsESG Committee (Chair) worldwide, and sheworldwide. She was the Chief Executive of E.L. Rothschild LLC from 2002 to 2016. Holdings of E.L. Rothschild LLC include The Economist Group (UK). Lady de Rothschild has been a director of The Economist Newspaper Limited since October 2002. From 2004 to 2007, she was also Co-Chair of FieldFresh Pvt. Ltd., a 50-50 joint venture with Bharti Enterprises, established to develop the agricultural sector in India. From 1989 to 2002, she was President and Chief Executive Officer of FirstMark Holdings, Inc., which owned various telecommunications companies worldwide. Lady de Rothschild is on the Board of Directors of Nikola Corporation. She serves on the Board and Executive Committee of The Peterson Institute for International Economics. Lady de Rothschild is a trustee of the Rothschild Eranda Foundation and a board member of the International Advisory Board of Columbia University School of Law and the Alzheimer Drug Discovery Foundation.McCain Institute. She is a member of the Council on Foreign Relations (USA), Chatham House (UK), the International Advisory Council of Asia House (UK), the International Institute of Strategic Studies (UK), and the Foreign Policy Association (USA).Qualifications: expertiseexpertiseexperience ![]()

Jennifer Tejada

![[MISSING IMAGE: ph_jennifertejada-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_jennifertejada-bw.jpg)

Age 51

Class II

RICHARD Richard F. ZANNINOZannino ![[MISSING IMAGE: ph_richardzannino-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_richardzannino-bw.jpg)

Age 5863

Class IISubcommittee

Subcommittee* LLC, a position he has held since July 2009.LLC. He is a partner on the firm'sfirm’s Investment Committee and co-heads the consumer retail practice. Prior to joining CCMP Capital, Mr. Zannino was an independent retail and media advisor from February 2008 to June 2009. He was Chief Executive Officer and a member of the Board of Directors of Dow Jones & Company, Inc. from February 2006 until his resignation in January 2008, shortly after its acquisition by News Corp.2008. Mr. Zannino joined Dow Jones as Executive Vice President and Chief Financial Officer in February 2001 and was promoted to Chief Operating Officer in July 2002. From 1998 to 2001, he was Executive Vice President of Liz Claiborne, Inc., where he oversaw the finance, administration, retail, fragrance, and licensing divisions. From 1993 to 1998, Mr. Zannino was with Saks Fifth Avenue, serving as Vice President and Treasurer, Senior Vice President, Finance and Merchandise Planning, and then Executive Vice President and Chief Financial Officer. He is a directoron the boards of directors of IAC/InterActiveCorp, and Ollie'sOllie’s Bargain Outlet Holdings, Inc. Additionally, within the past five years, Mr. Zannino served as a director of Francesca's Holdings Corporation., and Hillman Solutions Corp. (formerly The Hillman Companies, Inc.). He currently serves as Vice Chairman of the Board of Trustees of Pace University.Qualifications: Francesca'sFrancesca’s Holdings Corporation, IAC/InterActiveCorp, and Ollie'sOllie’s Bargain Outlet Holdings, Inc.expertiseexperience ![]()

Charlene Barshefsky ![[MISSING IMAGE: ph_charlenebarshefsky-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_charlenebarshefsky-bw.jpg)

Age 72

Class III

Committees: Wei Sun Christianson ![[MISSING IMAGE: ph_weisunchristianson-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_weisunchristianson-bw.jpg)

Age 66

Class III ![]()

Angela Wei Dong ![[MISSING IMAGE: ph_angelaweidong-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_angelaweidong-bw.jpg)

Age 48

Class III Fabrizio Freda ![[MISSING IMAGE: ph_fabriziofreda-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_fabriziofreda-bw.jpg)

Age 65

Class III ![]()

Jane Lauder ![[MISSING IMAGE: ph_janelauder-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_janelauder-bw.jpg)

Age 49

Class III Leonard A. Lauder ![[MISSING IMAGE: ph_leonardalauder-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_leonardalauder-bw.jpg)

Age 89

Class III ![]()

Paul J. Fribourg ![[MISSING IMAGE: ph_pauljfribourg-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_pauljfribourg-bw.jpg)

Age 68

Class I Jennifer Hyman ![[MISSING IMAGE: ph_jenniferhyman-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_jenniferhyman-bw.jpg)

Age 42

Class I ![]()

Arturo Nuñez ![[MISSING IMAGE: ph_arturonunez-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_arturonunez-bw.jpg)

Age 55

Class I Barry S. Sternlicht ![[MISSING IMAGE: ph_barryssternlicht-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-22-103951/ph_barryssternlicht-bw.jpg)

Age 61

Class I ![]()

Stockholders'Stockholders’ Agreement and Lauder Family Control. All Lauder Family Members who are party to a stockholders'stockholders’ agreement with the Company (the "Stockholders' Agreement"“Stockholders’ Agreement”) have agreed to vote shares beneficially owned by them for Leonard A. Lauder (or for one of his sons), Ronald S. Lauder (or for one of his daughters), and one person, if any, designated by each as a director of the Company. Aerin Lauder and Jane Lauder are parties to the Stockholders'Stockholders’ Agreement solely as trustees of certain trusts. The term "Lauder“Lauder Family Members"Members” is defined below (see "Certain“Certain Relationships and Related Transactions – Lauder Family Relationships and Compensation"Compensation”). Shares subject to the Stockholders'Stockholders’ Agreement represent approximately 84%83% of the voting power of the Company as of the Record Date. The right of each of Leonard A. Lauder (or his sons) and Ronald S. Lauder (or his daughters) to designate a nominee exists only when he (including his descendants) beneficially owns (other than by reason of the Stockholders'Stockholders’ Agreement) shares of Common Stock with at least 10% of the total voting power of the Company. Currently, William P. Lauder is the nominee of Leonard A. Lauder, and Jane Lauder is the nominee of Ronald S. Lauder. The right of each of Leonard A. Lauder (or one of his sons) and Ronald S. Lauder (or one of his daughters) to be nominated will exist so long as he (including his descendants) beneficially owns shares of Common Stock with at least 5% of the total voting power of the Company. In the event that Leonard A. Lauder ceases to be a member of the Board of Directors by reason of his death or disability, then his sons, William P. Lauder and Gary M. Lauder, will succeed to his rights to be nominated as a director and to designate one nominee. If either son is unable to serve by reason of his death or disability, the other son will have the right to designate a nominee. Similarly, Aerin Lauder and Jane Lauder, Ronald S. Lauder'sLauder’s daughters, will succeed to their father'sfather’s rights upon his death or disability. If either daughter is unable to serve by reason of her death or disability, the other daughter will have the right to designate a nominee. In the event none of Leonard A. Lauder and his sons and Ronald S. Lauder and his daughters are able to serve as directors by reason of death or disability, then the rights under the Stockholders'Stockholders’ Agreement to be a nominee and to designate a nominee will cease. The Stockholders'Stockholders’ Agreement contains a “sunset provision.” Under this provision, the Stockholders’ Agreement will terminate upon the occurrence of certain specified events, including the transfer of shares of Common Stock by a party to the Stockholders'Stockholders’ Agreement that causes all parties thereto immediately after such transaction to own beneficially in the aggregate shares having less than 10% of the total voting power of the Company.87%84% of the voting power of the Company as of the Record Date. The Company is a "controlled company"“controlled company” under the rules of the New York Stock Exchange (the "NYSE"“NYSE”) because the Lauder family and their related entities hold more than 50% of the voting power of the outstanding voting stock. As such, the Company may avail itself of exemptions relating to the independence of the Board and certain Board committees. Despite the availability of such exemptions, the Board of Directors has determined that it will have a majority of independent directors and that both the Nominating and Board AffairsESG Committee and the Compensation Committee will have otherwise required provisions in their charters. As permitted by the NYSE rules for "controlled“controlled companies,"” our Board does not require that the Nominating and Board AffairsESG Committee and the Compensation Committee be comprised solely of independent directors.

Board Committees. The Board of Directors has established the following standing committees –committees: the Audit Committee,Committee; the Compensation Committee (which includes the Stock Plan Subcommittee),; and the Nominating and Board AffairsESG Committee. Each director on these committees is an independent director except for William P. Lauder, who is a member of the Nominating and ESG Committee, and Richard D. Parsons.Parsons, who is a member of the Nominating and ESG Committee and the Compensation Committee. Each committee reports regularly to the Board and has the authority to engage its own advisors.Table From time to time, the Board considers the composition of Contents The membersour Board committees, and there have been a number of recent changes in our committee composition. Effective November 12, 2021, (i) Ms. Bravo left the Compensation Committee (and Stock Plan Subcommittee), (ii) Mr. Zannino joined the Compensation Committee (and Stock Plan Subcommittee), (iii) Mr. Fribourg became the Chair of the committees are set forth inCompensation Committee, and (iv) Ms. Christianson became the Chair of the Nominating and ESG Committee. Mr. Nuñez joined the Audit Committee ![]()

table: Director Audit

Committee Compensation

Committee

ESG

Committee Director AuditCommittee CompensationCommittee Nominating andBoard AffairsCommitteeCharlene Barshefsky†* ![]()

![]()

Rose Marie Bravo†![]()

Wei Sun Christianson![]()

Paul J. Fribourg†![]()

![]()

Mellody Hobson![]()

Wei Sun Christianson Irvine O. Hockaday, Jr.*![]()

William P. Lauder![]()

Richard D. Parsons![]()

![]()

Lynn Forester de Rothschild![]()

Barry S. Sternlicht![]()

![]()

Angela Wei Dong Richard F. Zannino†![]()

![]()

![]()

![]()

![]()

†Jennifer Hyman Also member of Stock Plan Subcommittee ![]()

![]()

= Chair *William P. Lauder Presiding Director ![]()

= Member ![]()

Arturo Nuñez ![]()

Richard D. Parsons ![]()

![]()

Lynn Forester de Rothschild ![]()

Barry S. Sternlicht ![]()

Jennifer Tejada ![]()

![]()

![]()

![]() Chair

Chair ![]() Member

Member"Investors"“Investors” section of the Company'sCompany’s website,www.elcompanies.comwww.elcompanies.com, under "Corporate“Corporate Governance." Stockholders may also contact Investor Relations at 767 Fifth Avenue, New York, New York 10153 or call 800-308-2334 to obtain a hard copy of these documents without charge.

Committee Company'sCompany’s Internal Control Department;Audit department; reviews audit results; reviews and discusses the Company'sCompany’s financial statements with management and the independent auditors; reviews and discusses with the Board the Company'sCompany’s policies for risk assessment and management processes;risk management; and is responsible for our related person transactions policy. The committee’s scope of oversight responsibilities includes information technology, cybersecurity, taxes, treasury, and legal matters. The committee also meets separately, at least quarterly,periodically with the Chief Financial Officer, the Chief Internal Control Officer,head of internal audit, and representatives of the independent auditors. The Board of Directors has determined that each of the committee members – Mr. Hockaday, ![]()

Ms. Hobson, and Mr. Zannino – qualifies as an "Audit“Audit Committee Financial Expert"Expert” in accordance with SEC rules.

Committee *Also a member of the Stock Plan Subcommittee Company'sCompany’s executive officers and administers the Company'sCompany’s Executive Annual Incentive Plan. The Stock Plan Subcommittee has authority over all decisions regarding awards to executive officers under the Company'sCompany’s share incentive plans and authority to administer the Company'sCompany’s share incentive plans under which executive officers and other employees may receive equity grants. The Company also has an Employee Equity Award Committee, the sole member of which is Mr. Freda. TheFreda; the purpose of this committee is to make limited grants of equity awards under the share incentive plan to employees who are not executive officers. During fiscal 2017, this committee did not make any grants.TableAs noted above, effective as of Contents The NominatingNovember 18, 2022, Ms. Tejada will join the Compensation Committee (and the Stock Plan Subcommittee), and Board AffairsMr. Zannino will leave the Compensation Committee among other things, recommends nominees for election as members of(and the Board; considers and makes recommendations regarding Board practices and procedures; considers corporate governance issues that arise from time to time and develops appropriate recommendations for the Board regarding such matters; and reviews the compensation for service as a Board member.

Compensation Committee Interlocks and Insider Participation. In During fiscal 2017,2022, Ambassador Barshefsky, Ms. Bravo, Mr. Fribourg, Mr. Parsons, and Mr. Zannino served on the Compensation Committee. None of these directors is a former or current officer or employee of the Company or any of its subsidiaries. During fiscal 2017,2022, none of our executive officers served as a member of the compensation committee (or other committee performing similar functions) or as a director of any other entity of which an executive officer served on our Board or Compensation Committee. None of the directors who served on our Compensation Committee during fiscal 20172022 has any relationship requiring disclosure under this caption under SEC rules.

ESG Committee

Board and Board Committee Meetings; Annual Meeting Attendance; and Executive Sessions. Directors are expected to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serve on the Board for an extended period of time. In furtherance of the Board'sBoard’s role, directors are expected to attend all scheduled Board and Board committee meetings and all meetings of stockholders. In fiscal 2017,2022, the Board of Directors met six times, the Compensation Committee and the Stock Plan Subcommittee each met five times, the Audit Committee met eight times, the Compensation Committee met five times (and the Stock Plan Subcommittee met five times), and the Nominating and Board AffairsESG Committee met threefour times. The total combined attendance for all Board and committee meetings in fiscal 2022 was over 90%95%. No director attended less than 75% of Board and committee meetings except for Mr. Parsons who attended approximately 65% of such meetings.in fiscal 2022. The non-employee directors met sixfive times in executive session in fiscal 2017, including at least one meeting at which only independent directors were present.2022. Directors are expected to attend the Annual Meeting of Stockholders. All of the directors who were on the Board attended theour Annual Meeting of Stockholders in November 2016, except one director who2021, which was unable to attend. ![]()

Our President and Chief Executive Officer is also a member of our Board of Directors. We alsoIn addition, we have an independent director who serves as our Presiding Director. A majority of our directors are independent. At present, there are 15the directors on our Board; 10Board are independent. As of our Record Date, there are 17 directors areon our Board, comprised of: (i) our President and Chief Executive Officer (“CEO”); (ii) 12 non-employee directors 9(11 of whom are independent); and (iii) 4 directors are independent, and 4 directorswho are members of the Lauder family. Mr. Hockaday, the currentfamily, including our Executive Chairman. The Presiding Director presides at all meetings or executive sessions of non-employee or independent directors. The Board of Directors considers this structure appropriate in view of the Lauder family'sfamily’s significant investment in the Company. The structure also comports with the Stockholders'Stockholders’ Agreement among various members of the Lauder family and the Company. See "Additional“Additional Information Regarding the Board of Directors – Stockholders'Stockholders’ Agreement and Lauder Family Control."President and Chief Executive OfficerCEO to set overall vision, strategy, financial objectives, and investment priorities for the business. Mr. W. Lauder also continues to provideprovides high-level leadership in areas that are important to the Company, including marketing, trade relations, global communications, social impact and sustainability, and regulatory affairs.we have an independent director who serves as our Presiding Director. The Presiding Director serves a one-year term beginning with the meeting of the Board immediately following the Annual Meeting of Stockholders and is selected from among the independent members of the Board. Mr.Stockholders. Irvine O. Hockaday, Jr. served as the Presiding Director for allinduring fiscal 2017, and2022 until he has beenleft the Board on November 12, 2021. Ambassador Barshefsky was appointed by the Board to serve as the Presiding Director for an additionala one-year term beginning after the 20172021 Annual Meeting (November 12, 2021), and she has served as the Presiding Director for all such executive sessions since that time. Ambassador Barshefsky has been re-appointed by the Board to serve as the Presiding Director for a one-year term beginning after the 2022 Annual Meeting. ![]()

![]()

President and Chief Executive OfficerCEO and other members of senior management regarding areas of significant risk to us, including strategic, operational, financial, legal and regulatory, cybersecurity, and reputational risks. However, senior management is responsible for assessing and managing the Company'sCompany’s various risk exposures on a day-to-day basis. In this regard, various management functions within the Company, such as Legal, Finance, Treasury, Internal Control, GlobalAudit, Information Systems,Technology, Global Supply Chain, Research & Development, and Environmental AffairsEnvironment, Health and Safety, focus on particular risks. Management has a systemic and integrated approach to overall risk management that includes the identification of risks and mitigation plans in the strategic planning process. The Board'sBoard’s role is one of oversight, assessing major risks facing the Company and reviewing options for their mitigation with management. In addition, the Audit Committee reviews and discusses with management our enterprise risk management processes.

Risk in Compensation Programs. The Company has a framework for evaluating incentive plan design features that may encourage or help mitigate risk, such as a mix of compensation elements, metrics, leverage, caps, and time horizons, in order to determine whether the risks arising from our compensation programs (in addition to those applicable only to executive officers) are reasonably likely to have a material adverse effect on the Company. Using this framework in fiscal 2017,2022, we concluded that our compensation programs are not reasonably likely to have a material adverse effect on the Company. The results were reviewed with senior management and the Compensation Committee.

Board Membership Criteria. The Nominating and Board AffairsESG Committee works with the Board on an annual basis to determine the appropriate characteristics, skills, and experience for the Board as a whole and its individual members. The Committee has engaged a third-party firm to assist with identifying and evaluating potential director candidates. Arturo Nuñez and Angela Wei Dong were each identified as a potential director candidate by such third-party firm. In accordance with the process described below, each candidate was evaluated by the Nominating and ESG Committee, and at the committee’s recommendation, the Board elected Mr. Nuñez to the Board effective April 25, 2022 and Ms. Dong to the Board effective July 11, 2022.today'stoday’s business environment; understanding of the Company'sCompany’s business on a technical level; and educational and professional background. The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best support the success of the business and, based on its diversity of experience, represent stockholder interests through the exercise of sound judgment. In determining whether to recommend a director for re-election, the Nominating and Board AffairsESG Committee also considers the director'sdirector’s past attendance at meetings and participation in and contributions to the activities of the Board.additional or replacement Board members,a new director candidate, the Nominating and Board AffairsESG Committee will identify one or more director candidates and evaluate each candidate under the criteria described above based on the information it receives with a recommendation or that it otherwise ![]()

candidate'scandidate’s independence, skills, and qualifications and the criteria described above, the Committee will make recommendations regarding potential director candidates to the Board. The Committee may engage third parties to assist in the search for director candidates or to assist in gathering information regarding a candidate's background and experience. The Committee will evaluate stockholder-recommended candidates in the same manner as other candidates. Candidates may also be designated pursuant to the Stockholders'Stockholders’ Agreement. See "Additional“Additional Information Regarding the Board of Directors – Stockholders'Stockholders’ Agreement and Lauder Family Control."”

Board Independence Standards for Directors. To be considered "independent"“independent” for purposes of membership on the Company'sCompany’s Board of Directors, the Board must determine that a director has no material relationship with the Company, including any of its subsidiaries, other than as a director. For each director, the Board broadly considers all relevant facts and circumstances. In making its determination, the Board considers the following categories of relationships to be material, thus precluding a determination that a director is "independent:"(ii)(iii)Company'sCompany’s internal or external auditor, (B) the director has an immediate family member who is a current employeepartner of such a firm, (C) the director has an immediate family member who is a current employee of such a firm and personally works on the Company'sCompany’s audit, or (D) the director or an immediate family member of the director was within the last three years a partner or employee of such a firm and personally worked on the Company'sCompany’s audit within that time.(iv)Company'sCompany’s present executive officers at the same time serves or served on that company'scompany’s compensation committee.(v)company'scompany’s consolidated gross revenues."material"“material” relationships that would impair a director'sdirector’s independence:(ii)company'scompany’s consolidated gross revenues, whichever is greater."immediate“immediate family member"member” includes a director'sdirector’s spouse, parents, children, siblings, mothersmothers- and fathers-in-law, sonssons- and daughters-in-law, brothersbrothers- and sisters-in-law, and anyone (other than domestic employees) who shares such person'sperson’s home. ![]()